As of 2014-12-20 (updates daily):

The Stock Market is Significantly Overvalued. Based on historical ratio of total market cap over GDP (currently at 127.7%), it is likely to return 0.6% a year from this level of valuation, including dividends.

What returns can we expect from the stock market?

As of today, the Total Market Index is at $ 21727.5 billion, which is about 127.7% of the last reported GDP. The US stock market is positioned for an average annualized return of 0.6%, estimated from the historical valuations of the stock market. This includes the returns from the dividends, currently yielding at 2%.

As pointed by Warren Buffett, the percentage of total market cap (TMC) relative to the US GNP is “probably the best single measure of where valuations stand at any given moment.”

Over the long term, the returns from stock market are determined by these factors:

1. Interest rate

Interest rates “act on financial valuations the way gravity acts on matter: The higher the rate, the greater the downward pull. That's because the rates of return that investors need from any kind of investment are directly tied to the risk-free rate that they can earn from government securities. So if the government rate rises, the prices of all other investments must adjust downward, to a level that brings their expected rates of return into line. Conversely, if government interest rates fall, the move pushes the prices of all other investments upward.”—Warren Buffett

2. Long Term Growth of Corporate Profitability

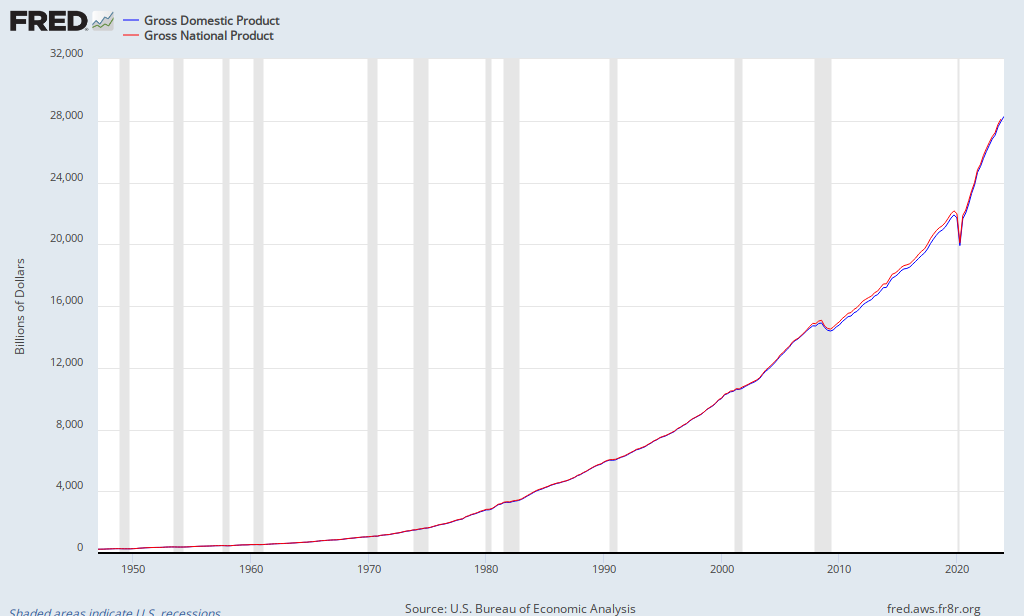

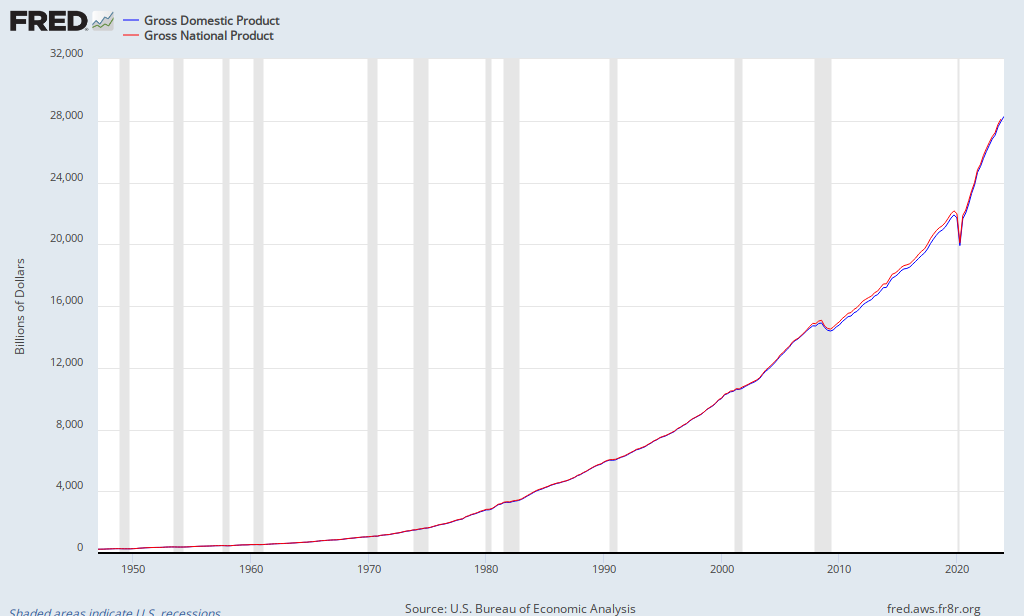

Over the long term, corporate profitability reverts to its long term-trend, which is around 6%. During recessions, corporate profit margins shrink, and during economic growth periods, corporate profit margins expand. However, long-term growth of corporate profitability is close to long-term economic growth. The size of the US economy is measured by Gross National Product (GNP). Although GNP is different from GDP (gross domestic product), the two numbers have always been within 1% of each other. For the purpose of calculation, GDP is used here. The U.S. GDP since 1970 is represented by the green line in the first of the three charts to the right.

3. Market Valuations

Over the long run, stock market valuation reverts to its mean. A higher current valuation certainly correlates with lower long-term returns in the future. On the other hand, a lower current valuation level correlates with a higher long-term return. The total market valuation is measured by the ratio of total market cap (TMC) to GNP -- the equation representing Warren Buffett's "best single measure". This ratio since 1970 is shown in the second chart to the right. Gurufocus.com calculates and updates this ratio daily. As of 12/20/2014, this ratio is 127.7%.

We can see that, during the past four decades, the TMC/GNP ratio has varied within a very wide range. The lowest point was about 35% in the previous deep recession of 1982, while the highest point was 148% during the tech bubble in 2000. The market went from extremely undervalued in 1982 to extremely overvalued in 2000.

Based on these historical valuations, we have divided market valuation into five zones:

| Ratio = Total Market Cap / GDP | Valuation |

| Ratio < 50% | Significantly Undervalued |

| 50% < Ratio < 75% | Modestly Undervalued |

| 75% < Ratio < 90% | Fair Valued |

| 90% < Ratio < 115% | Modestly Overvalued |

| Ratio > 115% | Significantly Overvalued |

| Where are we today (12/20/2014)? | Ratio = 127.7%, Significantly Overvalued |

A quick refresher (Thanks to Greenbacked): GDP is “the total market value of goods and services produced within the borders of a country.” GNP is “is the total market value of goods and services produced by the residents of a country, even if they’re living abroad. So if a U.S. resident earns money from an investment overseas, that value would be included in GNP (but not GDP).” While the distinction between the two is important because American firms are increasing the amount of business they do internationally, the actual difference between GNP and GDP is minimal as this chart from the St Louis Fed demonstrates:

GDP in Q4 2012 stood at $15,851.2 billion. GNP at Q3 2012 (the last data point available) stood at $16,054.2 billion. For our present purposes, one substitutes equally as well for the other.

The Sources of Investment Returns

The returns of investing in an individual stock or in the entire stock market are determined by these three factors:

1. Business growth

If we look at a particular business, the value of the business is determined by how much money this business can make. The growth in the value of the business comes from the growth of the earnings of the business growth. This growth in the business value is reflected as the price appreciation of the company stock if the market recognizes the value, which it does, eventually.

If we look at the overall economy, the growth in the value of the entire stock market comes from the growth of corporate earnings. As we discussed above, over thelong term, corporate earnings grow as fast as the economy itself.

2. Dividends

Dividends are an important portion of the investment return. Dividends come from the cash earning of a business. Everything equal, a higher dividend payout ratio, in principle, should result in a lower growth rate. Therefore, if a company pays out dividends while still growing earnings, the dividend is an additional return for the shareholders besides the appreciation of the business value.

3. Change in the market valuation

Although the value of a business does not change overnight, its stock price often does. The market valuation is usually measured by the well-known ratios such as P/E, P/S, P/B etc. These ratios can be applied to individual businesses, as well as the overall market. The ratio Warren Buffett uses for market valuation, TMC/GNP, is equivalent to the P/S ratio of the economy.

What Returns Is the Market Likely to Deliver From This Level?

Putting all the three factors together, the return of an investment can be estimated by the following formula:

Investment Return (%) = Dividend Yield (%)+ Business Growth (%)+ Change of Valuation (%)

The first two items of the equation are straightforward. The third item can be calculated if we know the beginning and the ending market ratios of the time period (T) considered. If we assumed the beginning ratio is Rb, and the ending ratio is Re, then the contribution in the change of the valuation can be calculated from this:

(Re/Rb)(1/T)-1

The investment return is thus equal to:

Investment Return (%) = Dividend Yield (%) + Business Growth(%) + (Re/Rb)(1/T)-1

This equation is actually very close to what Dr. John Hussman uses to calculate market valuations. From this equation we can calculate the likely returns an investment in the stock market will generate over a given time period. In the calculation, the time period we used was 8 years, which is about the length of a full economic cycle. The calculated results are shown in the final chart to the right. The green line indicates the expected return if the market trends towards being undervalued (TMC/GNP=40%) over the next 8 years from current levels, the red line indicates the return if the market trends towards being overvalued (TMC/GNP=120%) over the next 8 years. The blue line indicates the return if the market trends towards being fair-valued (TMC/GNP=80%) over the next 8 years.

The thick bright yellow line in the bottom right chart is the actual annualized return of the stock market over 8 years. We use "Wilshire 5000 Full Cap Price Index" to do the actual return calculation. We can see the calculations largely predicted the trend in the returns of the stock market. The swing of the market’s returns is related to the change in interest rates.

It has been unfortunate for investors who entered the market after the late 1990s. Since that time, the market has nearly always been overvalued, only dropping to fairly valued since the declines that began in 2008. Since Oct. 2008, for the first time in 15 years, the market has been positioned for meaningful positive returns.

As of 12/20/2014, the stock market is likely to return 0.6% a year in the next 8 years.

Based on these factors, Warren Buffett has made a few market calls in the past. In Nov. 1999, when the Dow was at 11,000, and just a few months before the burst of dotcom bubble, the stock market had gained 13% a year from 1981-1998. Warren Buffett said in a speech to friends and business leaders, “I'd like to argue that we can't come even remotely close to that 12.9... If you strip out the inflation component from this nominal return (which you would need to do however inflation fluctuates), that's 4% in real terms. And if 4% is wrong, I believe that the percentage is just as likely to be less as more.”

Two years after the Nov. 1999 article, when the Dow was down to 9,000, Mr. Buffett said, “I would expect now to see long-term returns run somewhat higher, in the neighborhood of 7% after costs.”

"Nine years have passed since the publication of the article of November 22, 1999, and it has been a wild and painful ride for most investors; the Dow climbed as high as 14,000 in October 2007 and retreated painfully back to 8,000 today." Warren Buffett again wrote in Oct. 2008: "Equities will almost certainly outperform cash over the next decade, probably by a substantial degree."

Source: Board of Governors of the Federal Reserve System and U.S. Bureau of Economic Analysis

Source: Board of Governors of the Federal Reserve System and U.S. Bureau of Economic Analysis